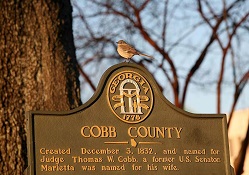

By now, the benefits of hiring a Cobb property tax consultant as a third-party vendor that provide a wide range of tax services should be evident by now. In brief, these benefits include freeing up valuable internal resources including manpower hours for expansion purposes and mitigating the risks associated with non-compliance with the law.