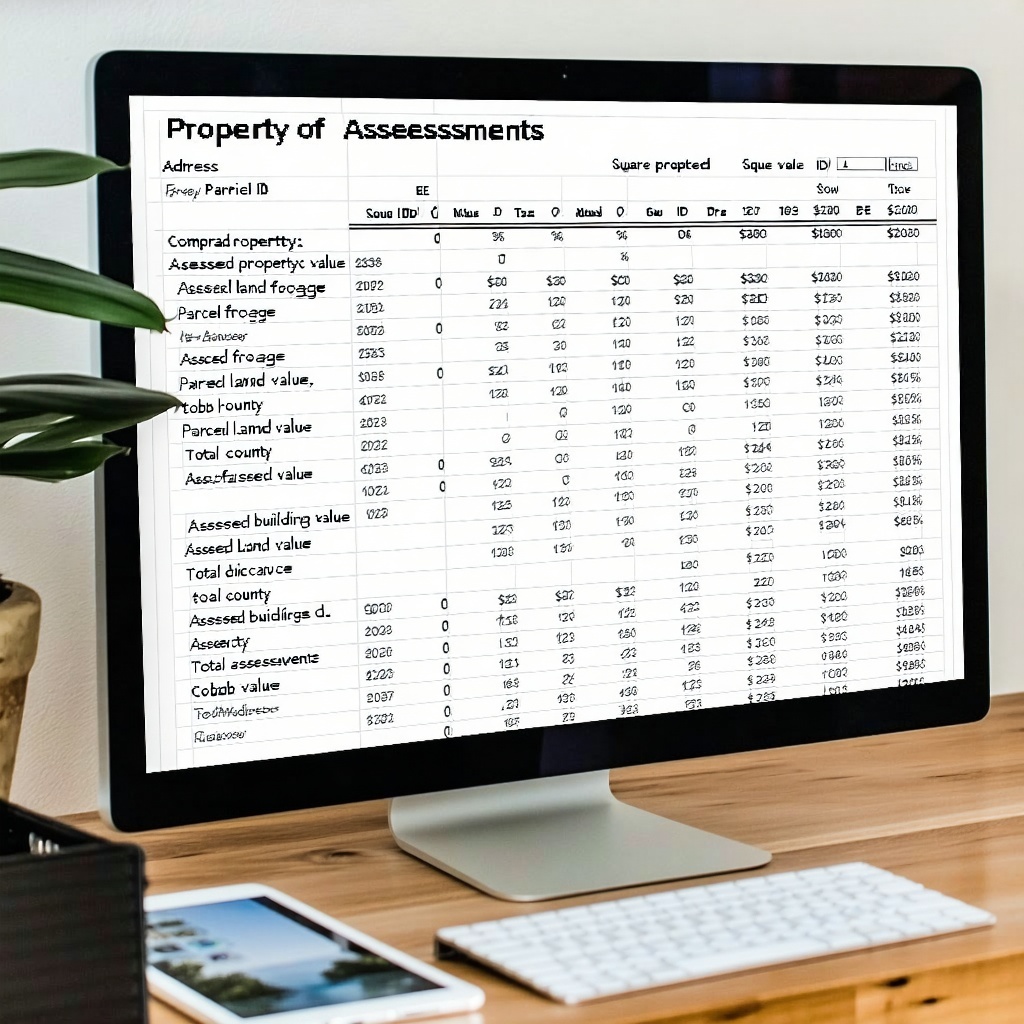

In DeKalb County, Georgia, your property's specific physical and locational attributes are the foundation of its tax assessment. Each year, the DeKalb County Board of Tax Assessors (BOA) appraises real property based on its fair market value as of January 1st. These valuations are governed by Georgia law and rely heavily on the individual characteristics of your property.