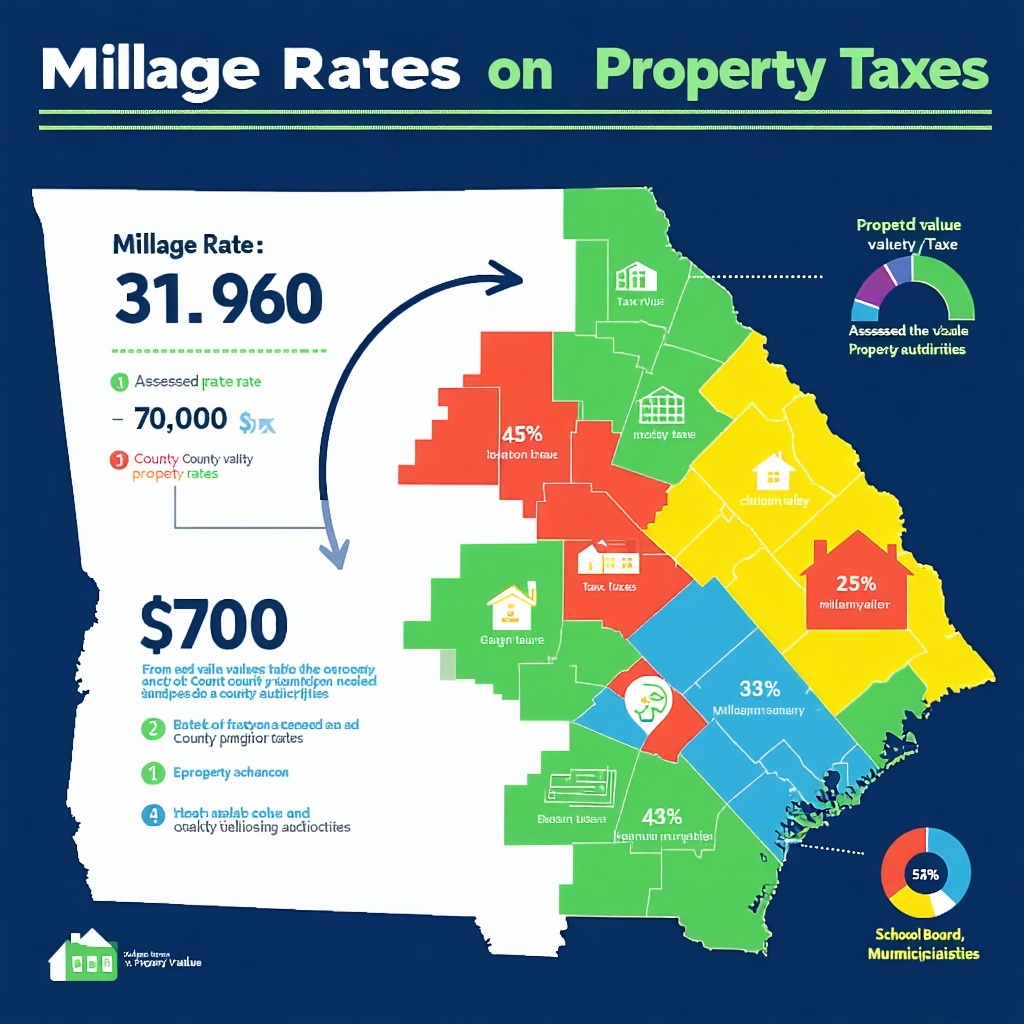

Georgia House Bill 581 (HB 581), enacted in 2024, introduces significant reforms to the state's property and local sales tax systems, primarily through the establishment of a statewide floating homestead exemption. Home - Gwinnett County Public Schools+4ACCG+4Georgia General Assembly+4