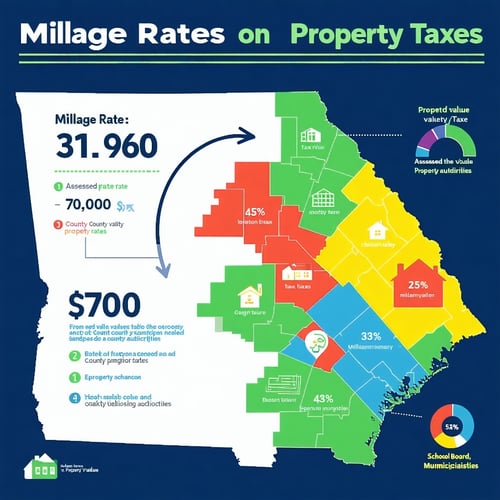

Millage rates are a crucial component in determining how much property tax you pay in Clayton County, Georgia. Understanding what millage rates are, how they’re set, and how they affect your tax bill is essential for every property owner.

What Is a Millage Rate?

A millage rate (or “mill rate”) is the tax rate used to calculate your property tax. It represents the amount of tax owed per $1,000 of your property's assessed value.

-

One mill = $1 of tax per $1,000 of assessed value

-

For example, a millage rate of 25 mills means you’ll pay $25 in tax for every $1,000 of assessed value.

💡 To convert mills into a decimal for calculation: divide the millage rate by 1,000.

Example: 25 mills = 0.025

Who Sets Millage Rates in Clayton County?

Millage rates are established annually by the various taxing authorities within Clayton County:

-

Clayton County Board of Commissioners:

Sets the rate for county services (Maintenance & Operations or “M&O”). -

Clayton County Board of Education:

Sets the school millage rate—usually the largest portion of your tax bill. -

City Governments:

If your property is within one of Clayton County's seven incorporated cities (College Park, Forest Park, Jonesboro, Lake City, Lovejoy, Morrow, or Riverdale), you may also pay a city millage rate for additional municipal services. -

Special Taxing Districts:

In some areas, additional millage rates apply:-

Fire District: Clayton County has a fire services millage that applies to Lovejoy, Jonesboro, Lake City, and unincorporated areas served by Clayton County Fire & Emergency Services.

-

Each taxing authority sets its rate based on its annual budgetary needs, which is why rates can change each year.

How Millage Rates Affect Your Property Taxes

Here’s the basic formula used in Clayton County:

(Taxable Assessed Value ÷ 1,000) × Total Millage Rate = Property Tax

Let’s define the components:

-

Fair Market Value (FMV):

The Clayton County Tax Assessor estimates your property's market value as of January 1st of each year. -

Assessed Value:

In Georgia, residential properties are taxed at 40% of FMV. -

Taxable Assessed Value:

This is the assessed value minus applicable exemptions, such as the homestead exemption. -

Total Millage Rate:

This is the combined rate from all taxing authorities relevant to your property’s location (county, school board, city, fire district, etc.).

Example Tax Bill Calculation

Let’s say:

-

Fair Market Value (FMV) = $200,000

-

Assessed Value (40%) = $80,000

-

Homestead Exemption = $10,000

-

Taxable Assessed Value = $70,000

-

Total Millage Rate = 12.360 (County) + 19.600 (School) = 31.960 mills (Based on 2024 rates)

Calculation:

($70,000 ÷ 1,000) × 31.960 = 70 × 31.960 = $2,237.20

This would be your estimated annual property tax.

Key Takeaways

✅ Higher Millage = Higher Tax

Even if your property value stays the same, a rise in the millage rate can increase your tax bill.

✅ Location Matters

Living inside a city like Jonesboro or Morrow means you'll likely pay additional city millage rates, compared to properties in unincorporated areas.

✅ Millage Rates Can Change Yearly

Taxing authorities set millage rates based on budget demands—they can go up or down each year.

✅ Review Your Tax Bill

Your tax bill will itemize each millage rate applied by taxing authorities so you can see where your tax dollars are going.

📚 Resources for Clayton County Property Tax & Millage Rates

-

Clayton County Tax Assessor's Office

Phone: (770) 477-3285

Services: Property valuations, exemptions, assessment notices -

Clayton County Tax Commissioner's Office

Phone: (770) 477-3331

Services: Tax billing, payment, and historical millage rate data -

Clayton County Millage Rate History (via Tax Commissioner's site)