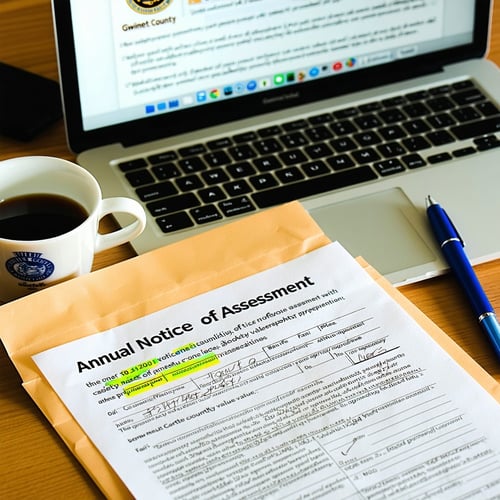

Receiving your Annual Notice of Assessment from Gwinnett County might not be the most exciting piece of mail — but it's one you cannot afford to ignore. This document tells you how the county values your property for tax purposes and kicks off a critical 45-day window to challenge the assessment if you believe it's inaccurate.

Missing this deadline could mean being locked into an inflated property tax bill for the entire year. Here's what you need to know about this deadline — and how to respond in time.

What Is the Annual Notice of Assessment?

This notice, typically mailed by the Gwinnett County Tax Assessor’s Office, includes:

-

The Fair Market Value (FMV) of your property as of January 1 of the current tax year

-

The assessed value, which is 40% of the FMV (standard for residential property in Georgia)

-

Any applicable homestead exemptions

-

The appeal deadline – which is 45 days from the notice date

This is not your property tax bill — it’s the valuation used to calculate it.

Why the 45-Day Deadline Matters

This deadline is not flexible. Under Georgia law (O.C.G.A. § 48-5-311), property owners have exactly 45 days from the official mailing date of the notice to file an appeal. If you miss this window, you forfeit your right to contest the value for that tax year.

When Does the Clock Start?

The 45-day appeal period starts from the “Annual Assessment Notice Date,” printed on the upper right-hand corner of the form — not the day you receive it in your mailbox. The law uses the county’s official mailing date, so don’t delay even if it arrives late.

What Happens If You Miss the Deadline?

If you don’t file your appeal within 45 days:

-

You accept the county’s valuation, even if you believe it’s too high

-

You must pay property taxes based on the assessed value

-

You won’t be able to challenge it until the next tax year

What You Should Do Within the 45 Days

1. Open and Review the Notice Immediately

Don’t set it aside. Read the values, exemptions, and appeal deadline as soon as it arrives.

2. Research Comparable Sales

Compare the county’s value to recent sales of similar properties in your neighborhood. Look for:

-

Homes of similar size, age, and condition

-

Sales that occurred close to January 1 of the current year

You can start with sites like Zillow or Realtor.com and confirm with the Gwinnett County Assessor’s website.

3. Identify Errors in Property Details

Check for factual inaccuracies such as:

-

Incorrect square footage

-

Wrong number of bedrooms or bathrooms

-

Features you don’t have (e.g., finished basement, pool)

4. Gather Supporting Evidence

If you decide to appeal, you’ll need evidence, which may include:

-

Recent sales of similar properties that sold for less

-

Photos of defects or repair issues

-

Contractor estimates for needed repairs

-

Independent appraisal (optional but helpful)

5. File Your Appeal

Submit your appeal before the deadline:

-

Online: fastest and most reliable

-

By Mail: Use Georgia’s official PT-311A Appeal Form and ensure it’s postmarked before the 45-day deadline

Don’t Let the Clock Run Out

Your 45-day window is your only opportunity each year to dispute your Gwinnett County property assessment. Once it closes, you’re locked into that value for the year. Review your notice, do your research, and act quickly if the county’s valuation seems inaccurate.

This is your right as a property owner — and potentially your chance to reduce your tax bill.

Resources

-

Gwinnett County Board of Tax Assessors

Search property records, view assessments, and file appeals online. -

Gwinnett County GIS Viewer

Use to verify lot lines, aerial views, and surrounding property data. -

Gwinnett County Tax Commissioner

For questions about billing, deadlines, or payment.