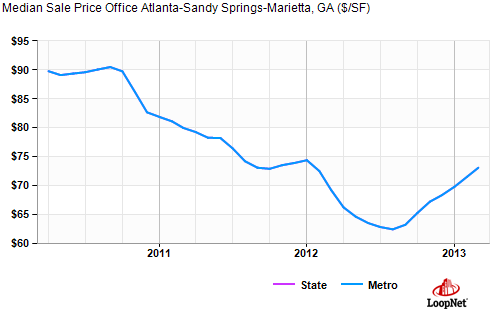

Today we are looking at the trend in office values in the Atlanta metro area. Based on information from LoopNet sale price per square foot has been on an uptrend for approximately six months. The median sale price at the start of this year was approximately $70/SF.

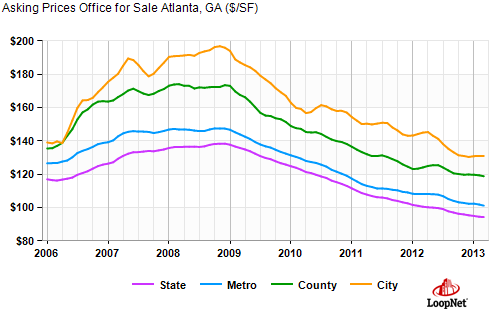

The office building list prices show that asking prices are much higher than sale prices and the trend in asking price is down. The asking price at the beginning of this year is near $100/SF and the median sale price from this same time is nearly 30% lower.

CoStar shows a roller coaster ride of sale prices over the past five years. A value of approximately $120 per foot is a midpoint for this range including the including the up and down of the past year.

CoStar office building list prices show the average list price per foot has been declining for approximately three years. The average list price at the beginning of this year was approximately $95/SF. This is much lower than the midpoint of the sale price per square foot range and is closer to the bottom of the sale price per foot range seen above.

For this office building data the LoopNet and CoStar list prices are similar but the sale price data diverges. The LoopNet average list price of approximately $100/SF in January is close to the estimated CoStar average list price of $95/SF. LoopNet's average metro Atlanta sale price was at $70/SF in January and CoStar's was $80/SF although it turned on a dime and headed over $150/SF in the first quarter of this year. It appears that the gyrations in the SP/SF of the CoStar data set may be because there are few sales, perhaps only one per quarter, but that is not the case. There are many sales per quarter in this data set.

A quick look at cap rates shows Realty Rates has an average cap rate for central business district office properties at 10.36% and suburban office at 9.46%. Medical office has an average cap rate of 9.1%. Real Estate Research Corporation shows an Atlanta central business district cap rate of 8.6% and a suburban cap rate of 9.3%. The suburban office cap rates from these two publications are similar, but they diverge on central business district office. Realty Rates takes a national view where RERC gets more localized. However, the RERC cap rates are for newer properties in the best locations, where Realty Rates is a blended rate of the best and the not-so-good.

There is still time to appeal your office building assessment in metro Atlanta. Today is the last day to file a property tax appeal in Gwinnett County. There is still time to appeal your taxable value in Cobb County, Hall County, Clayton County, DeKalb County, and Fulton County.