Gwinnett County property tax is higher than average for the Atlanta metro area. Gwinnett County property tax rates aren't as high as DeKalb County and aren't as low as Cobb County. For the tax year 2012 the Gwinnett County government did not raise the millage rate. However, for 2013 some tax rates will rise and some will fall within Gwinnett County, Georgia. As reported by the Atlanta Journal-Constitution back in November, based on the settlement of a lawsuit between Gwinnett County and the incorporated cities within it, real estate owners within unincorporated Gwinnett County will see a tax increase, while those in incorporated areas may see an increase or a decrease, depending on how many County services they use.

Gwinnett County property tax assessment notices went out in early April 2012, so we may see 2013 tax assessment notices soon. These assessment notices inform you of the market value that your property tax will be based on, however, the property tax rate often isn't published until after the property tax appeal deadline has passed. After all of the property tax assessment notices have been sent out and property tax appeals have been filed, the Gwinnett County taxing authority determines what tax rate rate they need to fund the government. Tax bills are then calculated based on the current year rate and the assessed value and tax bills are sent out in August.

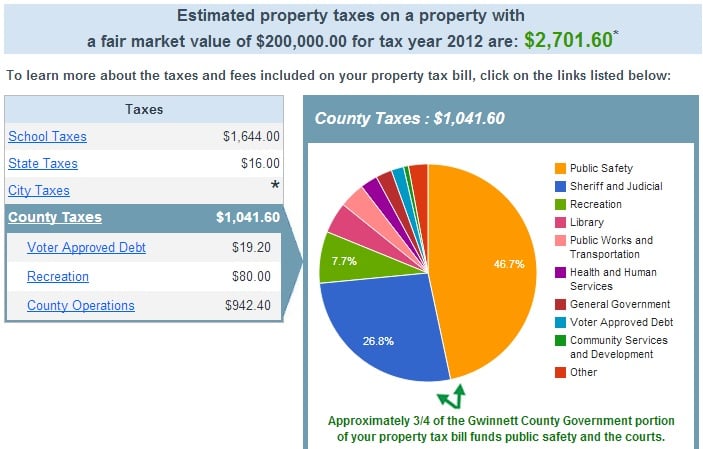

This chart was taken from the Gwinnett County Tax Commissioner's website. As you can see from this chart, the vast majority of Gwinnett County property tax goes to public safety and the courts. These two items account for nearly 75% of all Gwinnett County property tax expenditures. As you can see this chart does not include any school tax and it is also for property in unincorporated Gwinnett County because there are no city taxes included here. Although the incorporated areas within Gwinnett County have their own millage rates, all of the cities within Gwinnett County rely on the Gwinnett County Tax Assessor's office to establish the taxable values.

Gwinnett County Georgia was hard hit by the Great Recession, falling from its longtime status of one of the fastest growing counties in the country to a real estate meltdown like much of the rest of the Atlanta metropolitan area. The pressure to increase tax rates in the face of falling values was great, but Gwinnett County government cut back on as many expenses as possible and tried not to make things harder on their citizens by raising the rates. Although there are other counties in the Atlanta Metropolitan area that have lower unincorporated tax rates than Gwinnett County, Georgia most of the residents of Gwinnett County still think it's a good place to live and raise a family.