In the Income Approach, the deductions from gross income are typical and reasonable operating expenses, and taxes are considered typical and reasonable expense items. However, for tax assessment purposes, the taxes are not known. The values are being established so that the tax rate can be calculated for the current year. If the assessor is establishing a value for 2013 and is doing it at the beginning of the year, the tax rate is typically not known yet. If they are to include a tax component in the Income Approach as an operating expense, then they would have to use the prior year’s tax amount. Because the Income Approach and resulting value is going to have an impact on the current year’s tax rate, last year’s tax would affect the new tax rate. As a result there is a circular argument against using last year’s tax in the Income Approach.

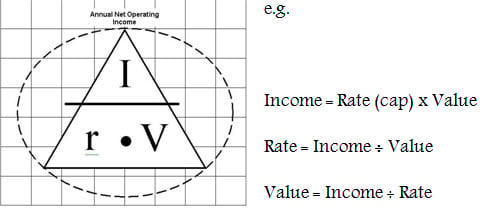

Instead of including property tax as an expense item, the tax assessors add their effective tax rate to the appropriate capitalization rate for a particular property type in a particular market area. This gives a property tax component influence on the final value, but it’s not used as an operating expense and it’s not used as an actual number, such as the prior year’s tax amount. The loaded capitalization rate is then applied to all net income produced by the property, which, in turn, produces a value estimate.