Net operating income (NOI) is defined by the Appraisal Institute as "the actual or anticipated net income remaining after all operating expenses are deducted from from effective gross income, but before mortgage debt service and book depreciation are deducted."

Effective gross income (EGI) is "the anticipated income from all operations of the real property adjusted for vacancy and collection losses. This adjustment covers losses incurred due to unoccupied space, turnover, and nonpayment of rent by tenants." This definition refers to market estimates of gross income adjusted for market vacancy and market collection losses. Your actual income may be very different from the "market."

In the world outside of real estate appraisal your actual annual income in any year is the equivalent of effective gross income, because your actual income reflects actual vacancy and collection losses. It is important to compare your actual annual income to the effective gross income the tax assessor is using. If the tax assessor is using an income approach to value for your property the income approach should be available to look at, usually on your property record card.

The tax assessor's effective gross income estimate is the first place in the income approach to value where things can get unreasonable. This will ultimately affect your net operating income estimate which affects your taxable value. If the assessor is using a much higher EGI than what you have collected then point this out. Insist that you have lower rents and higher vacancy (for example) for specific reasons, and that your property is not comparable to the market benchmarks the tax assessor is using.

From effective gross income, the operating expenses of the real estate are deducted to arrive at NOI. The operating expenses in the tax assessor's income approach may be understated, resulting in a high NOI and value. Compare your actual expenses to the tax assessor's estimate and point out any glaring differences. You may have to show several years of operating expenses to prove that your property has ongoing, high expenses.

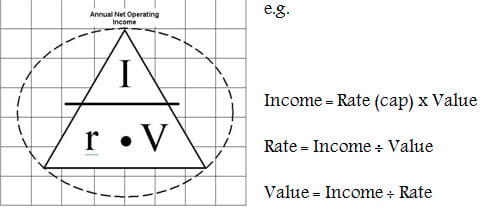

After you deduct the property's operating expenses from EGI you get NOI (net operating income). This is the dollar amount that is capitalized into a value estimate in real estate appraisal. The higher the NOI, the higher the taxable value. So you want to minimize EGI and maximize operating expenses to get the lowest NOI possible (for property tax appeal purposes).

If you need help with your commercial property tax appeal or would like a free consultation to determine whether a property tax appeal can save you money contact us at 404-644-1667.