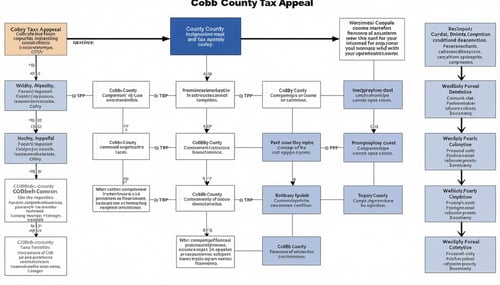

If you've filed a property tax appeal in Cobb County, Georgia, it's important to know what happens next. This guide outlines the typical steps and timelines involved in the appeal process.

✅ Step 1: Confirmation of Your Appeal

-

Online Filing: If you submitted your appeal online through the Cobb County Assessor's website, you should receive an immediate email confirmation.

-

Mail-in Filing: If you mailed your appeal, the Cobb County Board of Tax Assessors will send you a written acknowledgment. This may take a few weeks.cobbassessor.org

🔍 Step 2: Review by the Cobb County Board of Tax Assessors (BOA)

A staff appraiser from the BOA will review your appeal, including any supporting documents you've provided. They may also conduct their own analysis of your property and comparable sales.

-

Timeline: This review can take several weeks to a few months, depending on the number of appeals being processed.

📄 Step 3: BOA Decision

After reviewing your appeal, the BOA will take one of the following actions:

-

Issue a "30-Day Letter": Indicates a revised opinion of your property's value. You have 30 days to accept or reject this new value.

-

Issue a "No Change Letter": Indicates that the original valuation stands. Your appeal will then proceed to the next level, based on the option you selected during your initial filing.

🧭 Step 4: Further Appeal Options

Depending on your initial selection, your appeal may proceed to one of the following:

🧑⚖️ Board of Equalization (BOE) Hearing

-

Managed by the Cobb County Clerk of Superior Court.

-

You'll receive a notice of the hearing date, time, and location (typically 3-4 weeks in advance).

-

At the hearing, you or your representative can present your case, and a county appraiser will present theirs.

-

The BOE will make an independent decision on your property's value.

-

You'll receive a written decision within 10 days of the hearing, typically by certified mail.

⚖️ Non-Binding Arbitration

-

You and the BOA must agree on a neutral, certified appraiser.

-

You're typically responsible for the cost of your own appraisal.

-

The arbitrator reviews the evidence and issues a non-binding decision.

-

Either party can still appeal to Superior Court afterward.

🏢 Hearing Officer (for certain non-homestead properties)

-

Available for non-homestead real property with a fair market value exceeding a specific threshold (e.g., $500,000).

-

A certified appraiser acts as the hearing officer and makes a decision.

-

The Hearing Officer's decision can also be appealed to Superior Court.

🏛️ Step 5: Appeal to Superior Court (If Necessary)

If you disagree with the decision of the BOE, the Arbitrator (in a non-binding case), or the Hearing Officer, you have 30 days from the date of their decision to file an appeal with the Superior Court of Cobb County.

-

Timeline: The Superior Court process can be lengthy and may require legal representation.