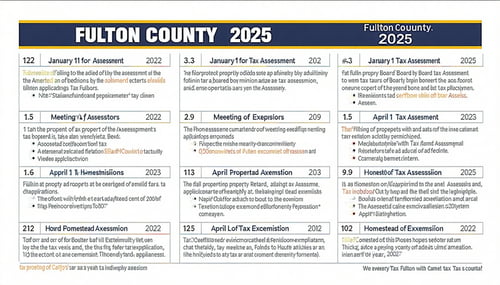

If you own residential or commercial property in Fulton County, understanding the 2025 property tax calendar is essential. The tax process involves several steps, from assessments to exemptions to bill payments, each with critical deadlines.

📅 Key Dates & Deadlines

📌 January 1, 2025 – Tax Assessment Date

-

This is the official "lien date" when property values are assessed for the 2025 tax year.

-

All taxable property is valued based on its condition and ownership status as of this date.

-

📖 Source: Georgia Department of Revenue – Property Tax Guide

📌 January 1 – April 1, 2025 – File Property Tax Returns

-

Property owners may file a Property Tax Return (PT-50R) if they disagree with the county’s value.

-

Filing is not required unless disputing the assessed value.

-

📖 Source: Georgia DOR – PT-50R Instructions

📌 April 1, 2025 – Deadline for Property Tax Returns & Homestead Exemption Applications

-

Last day to:

-

File a property tax return.

-

Apply for a homestead exemption for the 2025 tax year (must have owned and occupied the home on Jan 1, 2025).

-

-

📖 Sources:

📌 Spring–Summer 2025 – Annual Notice of Assessment

-

The Annual Notice of Assessment is mailed by the Fulton County Board of Assessors.

-

This notice includes your property's current market value and the 45-day window to file an appeal.

📌 Within 45 Days of Notice – Deadline to Appeal

-

If you disagree with the assessed value, file an appeal within 45 days of the date printed on your Notice of Assessment.

-

📖 Source: Fulton County – Appeals Info

📌 August 15, 2025 – City of Atlanta Property Tax Due (Installment 1)

-

Property taxes for City of Atlanta residents (within Fulton County) are typically due in two parts.

-

The first installment is due around mid-August.

-

📖 Source: City of Atlanta Property Tax FAQ

📌 October 15, 2025 – Fulton County Property Tax Due

-

For most properties in Fulton County, the main tax bill is due mid-October.

-

📖 Source: Fulton County Tax Commissioner

📝 Additional Notes

-

Tax Bills: Usually mailed in August, covering the full amount due in October. Always confirm directly with the Fulton County Tax Commissioner.

-

Penalties and Interest: Late payments incur penalties (1% per month) and interest.

-

Freeport Exemption for Businesses: Deadline to apply is also April 1, 2025, for qualifying inventory.