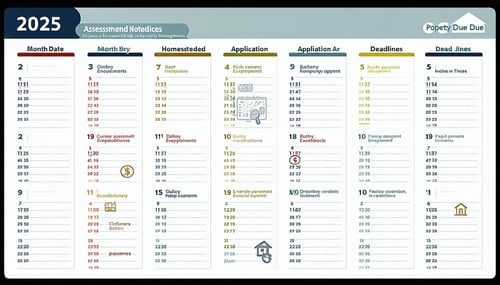

For Cobb County property owners, staying informed about key dates and deadlines within the property tax cycle is essential for effective management and potential appeal opportunities. The 2025 Cobb County property tax calendar outlines critical events, from assessment notices to payment due dates and appeal filing periods. Understanding this timeline will empower you to navigate the process smoothly and ensure you don't miss any important actions.

-

📅 Key Dates and Deadlines for Cobb County Property Taxes in 2025

🗓️ January 1, 2025 – Tax Assessment Date

Determines the value and condition of your property for the 2025 tax year. Ownership as of this date generally dictates tax responsibility.📝 January 1 – April 1, 2025 – Filing Period for Taxpayer Return of Real Property

File your own opinion of your property's value. Submissions must be made in person or postmarked by April 1.

🔗 File your return🏠 January 2 – April 1, 2025 – Homestead Exemption Application Period

Apply if your Cobb property was your primary residence as of Jan 1, 2025. Must be postmarked or received by April 1.

🔗 Apply for exemptions📬 Late April/Early May 2025 – Annual Assessment Notices Mailed

The Cobb County Board of Tax Assessors plans to mail residential notices around May 23, 2025. Watch your mailbox.

🔗 Assessment Info🛎️ 45 Days from Notice Date – Appeal Filing Deadline

You have 45 days from the date on your assessment notice to file an appeal. Missing this deadline means no appeal for 2025.

🔗 How to Appeal📨 By August 15, 2025 (Typically) – Property Tax Bills Mailed

Review your bill carefully for accuracy.

🔗 Check Tax Overview💰 October 15, 2025 (Typically) – Property Tax Payment Due Date

Taxes are due around October 15. Payments must be received or postmarked by this date to avoid penalties.

🔗 Check Payment Info

ℹ️ Important Notes for Cobb County Property Owners

-

♻️ Homestead Exemption Renewal: Once approved, it usually renews automatically if your property and residency status haven’t changed.

-

📬 Tax Bills: Typically mailed by late summer or early fall.

-

💻 Payment Options: Pay online, by mail, phone, or in person.

🔗 Cobb Tax Payment Portal

📚 Resources

-