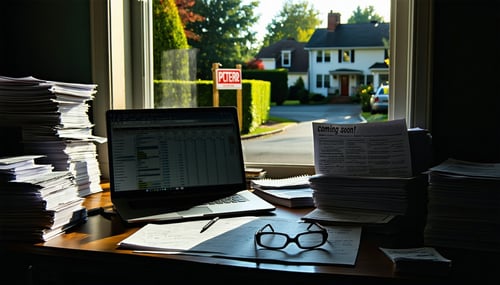

You meticulously researched comparable sales to challenge your latest property tax assessment, but something feels off. Could the "shadow inventory" – those unlisted properties lurking in the background – be undermining your efforts and your home's true value? Understanding this hidden market can be key to a successful appeal.

What Exactly is "Shadow Inventory"?

"Shadow inventory" refers to properties that are not actively listed for sale on the open market but are either:

- Distressed Properties: Homes in pre-foreclosure or owned by banks after foreclosure, which may be sold at a discount once they hit the market.

- "Coming Soon" Listings: Properties that agents are marketing privately before officially listing them on the MLS, often with a specific price point.

- Investor-Held Vacancies: Properties bought by investors and held vacant, potentially to be flipped or rented later, influencing overall supply and demand dynamics.

- Off-Market Deals: Properties sold privately through word-of-mouth or direct outreach, often without public price discovery.

The Hidden Impact on Property Values:

While not visible in standard comparable sales data, shadow inventory can exert a subtle but significant influence on the local real estate market and, consequently, your property's true value:

- Suppressed Prices: A large shadow inventory, particularly of distressed properties, can create downward pressure on overall home prices in the area once these properties eventually come to market at potentially lower values.

- Inaccurate Comparables: Relying solely on listed sales might not give a complete picture of the competitive landscape, especially if a significant number of similar properties are being quietly marketed or held off-market at different price points.

- Distorted Supply and Demand: The existence of a substantial shadow inventory can make it harder to accurately gauge the true balance of supply and demand in your neighborhood, potentially leading to an overvaluation of your property for tax purposes.

Why "Shadow Inventory" Matters for Your Tax Appeal:

Your property tax assessment should reflect your home's fair market value – what it would realistically sell for in the current market. If a significant shadow inventory exists in your area, the listed sales data your assessor relies on might not fully capture the downward pressure or the availability of potentially cheaper, unlisted alternatives. This discrepancy can be grounds for an appeal.

Building Your Case: Uncovering the Hidden Market:

Appealing your taxes based on the "shadow inventory" effect requires going beyond publicly available listings:

- Talk to Local Real Estate Agents: Experienced agents in your neighborhood often have insights into off-market activity, "coming soon" listings, and distressed properties that haven't officially hit the MLS. Their anecdotal evidence can be valuable.

- Monitor Pre-Foreclosure Notices: Public records of pre-foreclosure filings can indicate potential future shadow inventory.

- Network with Local Investors: Investors often have knowledge of off-market deals and vacant properties being held.

- Analyze Market Trends Carefully: Look for subtle signs of a larger-than-reported inventory, such as increasing days on market for listed properties or a slowdown in price appreciation despite seemingly low inventory.

- Consider an Expert Appraisal: A savvy local appraiser might be able to factor in the potential impact of shadow inventory on your property's value, even if it's not directly reflected in past sales data.

- Present Your Findings in Your Appeal: In your appeal documentation, explain the concept of shadow inventory and provide any evidence you've gathered that suggests its presence is influencing property values in your area. While hard data might be limited, well-reasoned arguments and expert opinions can be persuasive.

Navigating the Appeal Process:

Remember to follow your local tax authority's specific procedures for property tax appeals. Clearly articulate why you believe the standard comparable sales data doesn't accurately reflect the market due to the influence of unlisted properties.

Shining a Light on the Hidden Market:

While the "shadow inventory" can be elusive, understanding its potential impact on your property value is crucial. By digging deeper than publicly listed sales and presenting a well-reasoned argument, you might be able to shed light on this hidden market and achieve a more accurate and fair property tax assessment.