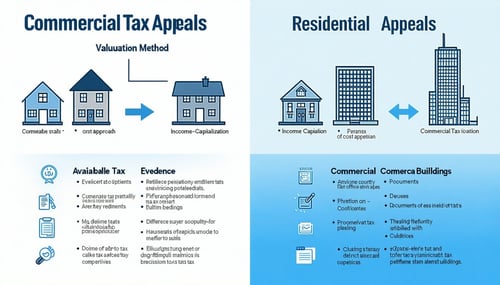

Appealing commercial property taxes in Clayton County, Georgia, follows the same fundamental process as residential property appeals but involves key differences in valuation methods, available evidence, and potential appeal strategies. Here's a breakdown of what you need to know:

Key Differences in Commercial Property Tax Appeals

1. Valuation Methods

-

Residential Properties: Primarily rely on the sales comparison approach, which assesses value based on recent sales of comparable properties.

-

Commercial Properties: Often evaluated using a combination of:

-

Income Capitalization Approach: Estimates value based on the property's income-generating potential, considering rental income, operating expenses, and an appropriate capitalization rate.

-

Cost Approach: Calculates value based on the cost to replace the property, minus depreciation, plus land value.

-

Sales Comparison Approach: Considers recent sales of similar commercial properties.

-

2. Available Evidence

Commercial property appeals require a broader range of financial and market data, including:

-

Lease Agreements: Details of current leases, rental rates, terms, and occupancy rates.

-

Income and Expense Statements: Profit and loss statements, operating expenses (maintenance, insurance, property management).

-

Capitalization Rate Data: Industry surveys or market analysis showing appropriate cap rates for similar properties.

-

Appraisals: Comprehensive evaluations focusing on income potential and market conditions.

-

Market Studies: Reports analyzing the local commercial real estate market, vacancy rates, and absorption rates.

-

Construction Costs: Detailed breakdowns of building costs and depreciation schedules (for the cost approach).

-

Environmental Reports: If environmental issues affect the property's value.

-

Expert Testimony: Testimony from commercial real estate appraisers, brokers, or market analysts.

-

"Lack of Uniformity" Arguments: Comparing similar commercial properties (e.g., office buildings with other office buildings) to demonstrate discrepancies in assessments.

3. Hearing Officer Option

In Georgia, the Hearing Officer option is available for non-homestead real property with a fair market value in excess of $500,000, which often includes commercial properties. This provides an opportunity to have your case heard by a state-certified appraiser.

Strategies for Appealing Commercial Property Taxes in Clayton County

-

Review Your Assessment Notice and Property Record: Identify the valuation method used and any discrepancies in property characteristics.

-

Gather Comprehensive Financial Data: Compile detailed income and expense statements, lease agreements, and occupancy history.

-

Analyze Market Data: Research capitalization rates, vacancy rates, and rental rates for comparable commercial properties in Clayton County.

-

Consider a Professional Appraisal: Engaging a qualified commercial real estate appraiser can provide an independent valuation based on appropriate approaches and market analysis.

-

Focus on the Income Capitalization Approach: If your property generates income, assess whether the assessor's income projections, expense assumptions, or capitalization rate are reasonable.

-

Evaluate the Cost Approach: Scrutinize the replacement cost, depreciation calculations, and land value. Obtain independent cost estimates if necessary.

-

Build a Strong "Lack of Uniformity" Case: Identify comparable commercial properties in Clayton County with similar use, size, age, and location that have lower assessed values. Obtain their assessment data.

-

Present Clear and Organized Evidence: Ensure your documentation is well-organized and clearly supports your arguments.

-

Consider Expert Testimony: For complex appeals, consider having your appraiser or other real estate professionals testify at a BOE or Hearing Officer hearing.

-

Understand the Appeal Options: Familiarize yourself with the Board of Equalization, Non-Binding Arbitration, and Hearing Officer options available in Clayton County and choose the one that best suits your situation.

-

Meet All Deadlines: The 45-day deadline for filing the initial appeal is critical.

Key Differences in the Appeal Process

While the initial steps of filing an appeal within 45 days are the same for both residential and commercial properties in Clayton County, the complexity of commercial property valuation often leads to more intricate appeals and a greater reliance on professional expertise.

By understanding these key differences and tailoring your evidence and strategies accordingly, you can effectively navigate the process of appealing commercial property taxes in Clayton County.

Resources

-

Clayton County Tax Assessor – Commercial Property: https://www.claytoncountyga.gov/government/tax-assessor/commercial-property/

-

Clayton County Tax Assessor – Notice of Assessment Information: https://www.claytoncountyga.gov/government/tax-assessor/notice-of-assessment-information/

-

Georgia Department of Revenue – PT-311A Appeal of Assessment Form: https://dor.georgia.gov/pt-311a-appeal-assessment-form

-

Tips for Filing a Commercial Property Tax Appeal in Georgia: https://georgiataxappealinfo.com/tips-for-filing-a-commercial-property-tax-appeal-in-georgia/

-

Understanding the Clayton County Property Tax Appeal Process: https://www.fair-assessments.com/blog/understanding-the-clayton-county-property-tax-appeal-process