A “Lack of Uniformity” appeal asserts that your property is not being assessed equitably compared to similar properties in your area. Under Georgia law, uniformity in assessments is a constitutional requirement—meaning your property should not be taxed at a higher rate than similarly situated properties.

Here’s how to effectively argue this claim in your Fulton County property tax appeal:

1. 🏘️ Identify Truly Comparable Properties

Your uniformity argument is only as strong as the quality of your comparables.

-

Location: Choose homes on the same street, block, or within your subdivision.

-

Size: Similar square footage (within ±10–15% of your home).

-

Age & Style: Built around the same time and with a similar architectural style.

-

Features: Comparable number of bedrooms/bathrooms, garage, basement (finished or not), etc.

-

Condition: Properties should be similarly maintained and updated.

🚫 Avoid using properties that have:

-

Recent renovations or additions

-

Different lot sizes

-

Significantly different features

2. 🔍 Gather Assessment Data from the Fulton County Website

Use the Fulton County Property Search Tool to find the following for each comparable:

-

Parcel ID and address

-

Fair Market Value

-

Assessed Value (40% of FMV)

-

Living area (square footage)

-

Year built

-

Property characteristics

If you can, talk to neighbors and ask for copies of their recent assessment notices.

3. 🧮 Calculate and Compare Key Metrics

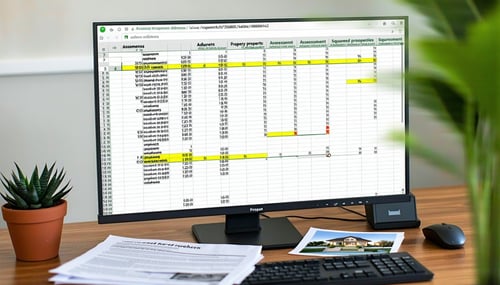

Create a spreadsheet or table showing:

| Address | Square Footage | Fair Market Value | FMV/SqFt | Assessed Value |

|---|

If your property is 2,000 sq ft with an FMV of $500,000, then:

FMV per Sq Ft = $500,000 ÷ 2,000 = $250/sq ft

Do the same for each comparable to determine how your property stacks up.

4. 📉 Highlight Discrepancies

In your appeal, emphasize any unjustified differences in value per square foot:

“My property is assessed at $275/sq ft, while the average for five nearly identical properties is $230/sq ft, a difference of over 19%. None of these comparables have significant improvements that would justify the discrepancy.”

Be clear and objective—show the math and summarize the gap.

5. 🧾 Address Potential Justifications in Advance

Disclose and rule out reasons for any differences:

-

If a comparable has a finished basement and yours does not, exclude it or explain the difference.

-

If your neighbor recently added a sunroom, acknowledge that it could justify a higher assessment.

-

Focus on comps that haven’t undergone significant changes.

This increases your credibility and strengthens your case.

6. 🗂️ Present Your Evidence Clearly

Include:

-

📊 Spreadsheet/Table of all comparables

-

📷 Photos (if visual similarity helps your case)

-

✍️ Written Explanation (keep it factual and concise)

Sample Summary:

“I am appealing my property tax assessment based on lack of uniformity. I’ve identified five properties located at [addresses] that are nearly identical to my home at [your address]. Despite being similar in size, condition, and features, my property is assessed at $275/sq ft, while the comparables average $230/sq ft. I respectfully request a reduction to ensure equity and consistency in assessment practices.”

⚠️ Important Notes

-

📆 Deadline: File your appeal within 45 days of the date on your Annual Notice of Assessment.

-

🔍 Use Official Data: All comparables must come from reliable, recent Fulton County assessments.

-

⚖️ Uniformity ≠ Market Value: This appeal argument is different from saying your property is overvalued—it’s about fairness relative to other properties.

-

🧠 Subjectivity Exists: The Board of Equalization may interpret “similarity” differently, so be prepared to make your case with facts.

📚 Official Resources

-

🏛️ Fulton County Board of Assessors – Appeals Portal

https://fultonassessor.org/property-appeals/ -

🔎 Fulton County Property Search

https://fultonassessor.org/property-search/ -

📄 GA Property Tax Appeal Form (PT-311A)

https://dor.georgia.gov/documents/property-tax-appeal-form-pt311a -

📍 Mailing Address

Fulton County Board of Assessors

235 Peachtree Street NE, Suite 1200

Atlanta, GA 30303 -

☎️ Phone: (404) 612-6440

-

✉️ Email: boa.web@fultoncountyga.gov