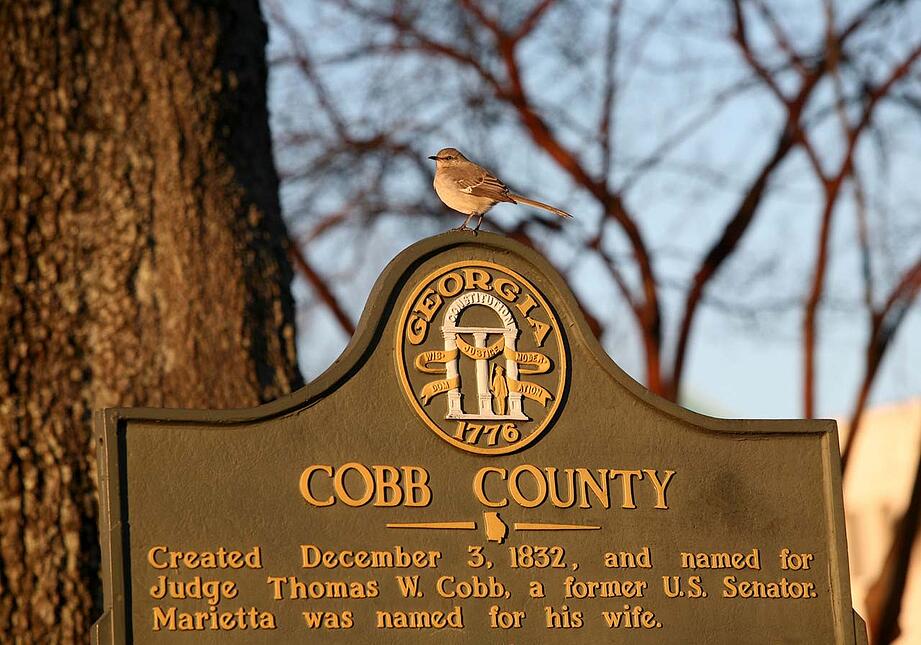

Your real estate investments are still among the best ways of cutting taxes and building wealth. Your Cobb county real estate tax consultant can discuss the ways in which putting off tax bills is possible with your real estate investments. Here’s a look at the numerous benefits of real estate ownership including tax savings.

Cost of Depreciation

By definition, depreciation is the deduction allowed for tangible assets, such as buildings, as a reasonable allowance for wear and tear, exhaustion, and obsolescence. Depreciation can decrease your tax bill since these are annual tax deductions and, thus, a way to recover the costs incurred in an income-producing property. Owners of rental property use depreciation as a valid tax deduction for this reason.

Emphasis must be made that only tangible assets can be depreciated – intangible assets, such as goodwill and marketable investments, can be written off but not depreciated. But not all tangible assets can be depreciated either since land and its associated costs of development (i.e., clearing, planting, and landscaping) cannot be subjected to it.

Instead, the buildings built on the land as well as the machinery, equipment, furniture and fixtures, and computers, among others, can be depreciated. In general, real estate owners use the modified accelerated cost recovery system in determining the depreciation of residential real property over 27.5 years.

Mortgage Interest Deductions

Yet another way that Cobb county real estate tax consultants reduce their clients’ tax bills is via mortgage interest deductions. Basically, you can deduct a portion of your mortgage payment that can be attributed to interest, said deduction should be reflected on your tax returns.

But keep in mind that these deductions aren’t the same in amount from one year to the next. This is because your mortgage payments will be higher during the early years. As you pay off your mortgage, you’re also paying decreased interest on it.

1031 Exchange

In this exchange, you are allowed to defer your taxes by selling one of your real estate investments and using its equity in purchasing another real property either of equal or greater value. You may also purchase more than one piece of real property from the equity.

But keep in mind that the exchange of real property investments must occur within a specific timeframe for it to be tax-deductible. The relinquished and replacement property must also meet stringent criteria including:

- The cumulative value of the replacement property must either be equal to or greater to the relinquished property.

- The relinquished and replacement property must be of the “like kind” meaning that both are of the same type. So, a piece of land cannot be exchanged for a real estate investment trust, for example.

- The relinquished and replacement property must be owned as an investment such that it serves productive purposes in trade or business.

Furthermore, you must also use a qualified agent to facilitate the exchange process.

Ask your Cobb county real estate tax consultants at Fair Assessments, LLC about the ways that you can build wealth using real estate investments while minimizing your tax liability. You will be surprised at the ways that this is possible.