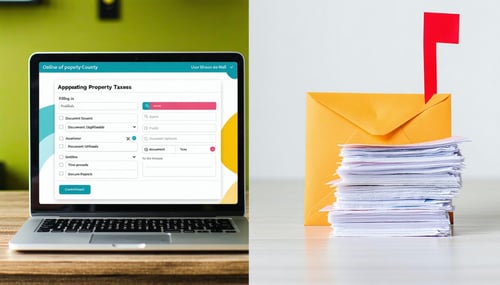

When it comes to appealing your DeKalb County property taxes, you have two primary methods for filing: online and by mail. 1 Each has its own set of advantages and disadvantages. Here's a breakdown to help you determine the best way for you:

Filing Online:

Pros:

- Convenience: You can file your appeal from the comfort of your home or office, at any time of day or night, as long as it's before the 45-day deadline.

- Speed and Efficiency: Online systems are generally faster for submitting information and ensure immediate receipt by the DeKalb County Tax Assessor's Office.

- Confirmation: You typically receive an electronic confirmation (email or on-screen message) that your appeal has been successfully submitted. This provides peace of mind and proof of timely filing.

- Ease of Providing Documentation: Online portals often allow you to easily upload supporting documents (comparable sales, photos, appraisal reports, etc.) directly with your appeal. This keeps everything organized and ensures it's submitted with your initial filing.

- Reduced Risk of Postal Delays: You eliminate the worry of your appeal getting lost or delayed in the mail, especially as the crucial 45-day deadline approaches.

- Potential for Guided Process: Some online systems may guide you through the required information, ensuring you complete all necessary fields and provide essential details.

- Accessibility: You can access the online portal from any device with internet access (computer, tablet, smartphone).

Cons:

- Technical Issues: You might encounter technical difficulties with the website (e.g., website downtime, issues with uploading documents).

- Comfort with Technology: Some individuals may be less comfortable navigating online forms and uploading files.

- Potential for System Overload: Although less likely, there's a slight risk of website slowdowns if a large number of people try to file at the last minute.

Filing by Mail:

Pros:

- Tangible Proof of Submission: You have a physical copy of your appeal form and supporting documents. You can also obtain proof of mailing (e.g., certified mail receipt) from the postal service.

- No Reliance on Technology: If you have limited internet access or are uncomfortable with online forms, mail is a viable option.

Cons:

- Slower and Less Efficient: Mailing takes time, and there's a risk of postal delays, especially close to the 45-day deadline.

- No Immediate Confirmation: You won't receive immediate confirmation that your appeal has been received by the Tax Assessor's Office. You'll have to rely on your mailing receipt.

- Potential for Lost Mail: Although relatively rare, there's always a chance that your appeal could get lost in the mail.

- Less Convenient for Attachments: You need to make physical copies of all your supporting documents and ensure they are properly included with your appeal form.

- Risk of Missing the Deadline Due to Postmarking: Your appeal must be postmarked within the 45-day window, not just mailed. If you wait until the last day, a late postmark will result in your appeal being rejected.

Which is the Best Way for You?

Generally, filing online is the recommended and often the best way to appeal your DeKalb County property taxes due to its speed, efficiency, convenience, and immediate confirmation. It also simplifies the process of submitting crucial supporting documentation directly with your appeal.

However, you might consider filing by mail if:

- You are not comfortable using online systems.

- You prefer having a physical copy and proof of mailing for your records.

- You have plenty of time before the 45-day deadline and are confident in the postal service's reliability.

Important Considerations:

- Deadline is Paramount: Regardless of the method you choose, ensure your appeal is submitted online or postmarked within the 45-day deadline from the date on your Annual Notice of Assessment.

- Follow Instructions Carefully: Whether online or by mail, read and follow all instructions provided by the DeKalb County Tax Assessor's Office.

- Keep Records: Retain copies of everything you submit, whether electronic or physical, for your records.

Recommendation:

Unless you have significant concerns about using online systems, filing your property tax appeal online through the DeKalb County Tax Assessor's website is generally the preferred method. It offers the most convenience, speed, and reliability, especially when dealing with the time-sensitive 45-day deadline. Just be sure to submit everything correctly and retain your confirmation.