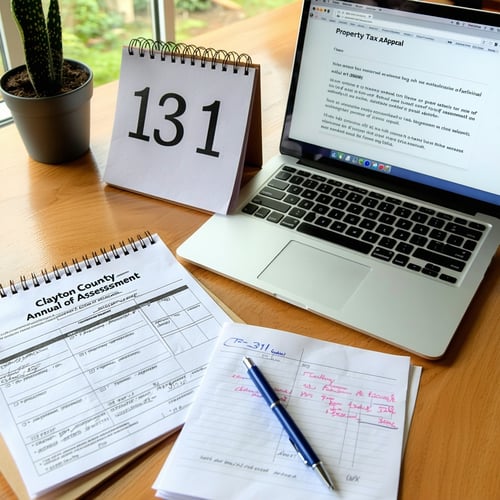

If you believe your Clayton County, Georgia property tax assessment doesn't accurately reflect your home’s fair market value, the good news is you have the right to appeal. This guide walks you through each step of the Clayton County property tax appeal process, from understanding your assessment to potentially presenting your case to the Board of Equalization (BOE).

✅ Step 1: Review Your Annual Notice of Assessment

When to Expect It:

The Clayton County Board of Assessors typically mails Annual Notices of Assessment in late April each year.

Key Items on the Notice:

-

Fair Market Value (FMV): The estimated value of your property as of January 1.

-

Assessed Value: 40% of FMV (standard for residential property in Georgia).

-

Exemptions Applied: Any homestead or other exemptions granted.

-

Deadline to Appeal: This is 45 days from the date printed on the notice.

-

Instructions for Filing an Appeal: Your notice will include how to appeal.

🛑 Important: This notice is not your tax bill, but it determines how much tax you’ll eventually owe.

✅ Step 2: Know Your Grounds for Appeal

In Georgia (and specifically in Clayton County), you may appeal your assessment on the following grounds:

-

Value: The FMV is too high.

-

Uniformity: Your property is assessed higher than similar nearby properties.

-

Factual Errors: Incorrect property information (square footage, bedrooms, features).

-

Denial of Exemption: You were wrongly denied a valid homestead or other exemption.

🚫 You cannot appeal just because you think your tax bill is too high—the appeal must be tied to the value or assessment accuracy, not the millage rate.

✅ Step 3: Gather Evidence to Support Your Appeal

To make a persuasive appeal, collect documentation such as:

-

Comparable Sales (Comps):

-

Recent (within 6–12 months)

-

Similar location, size, age, and condition

-

-

Independent Appraisal: Optional but often persuasive

-

Photos/Videos: Especially for visible property issues

-

Repair Estimates: For deferred maintenance or needed fixes

-

Correction Documents: If county records are incorrect (e.g., wrong number of bathrooms)

-

Exemption Proof: Deed, utility bills, or affidavits if your exemption was denied

✅ Step 4: Choose Your Method to File

You may file your appeal in one of three ways:

📲 Online (Recommended)

Use the Clayton County Board of Assessors' online portal (available on their official website). It's the fastest and most reliable method.

📬 By Mail

-

Download and complete Form PT-311A.

-

Mail it to the address provided on the form or your notice.

-

Use certified mail to prove submission.

-

It must be postmarked by the 45-day deadline.

🏢 In Person

-

You may also deliver your appeal form directly to the Clayton County Tax Assessor’s Office during business hours.

✅ Step 5: File Before the Deadline

-

Strict Deadline: You must file within 45 days of the notice date.

-

Be Accurate: Complete all required sections, attach evidence, and clearly explain your appeal grounds.

-

Keep Copies: Save everything you submit.

✅ Step 6: What Happens After You File?

Once your appeal is submitted:

-

The Board of Assessors will first review your case.

-

They may:

-

Agree and lower your value.

-

Disagree and send your case to the Board of Equalization (BOE).

-

-

You will receive a written notice of their decision or the next steps.

✅ Step 7: Prepare for the Board of Equalization Hearing

If your case goes before the BOE:

-

You’ll receive a hearing date and time.

-

The BOE is a panel of trained citizen volunteers.

-

Prepare to present your evidence clearly and concisely.

-

You may represent yourself or bring legal counsel or an appraiser.

🧑⚖️ If you disagree with the BOE's decision, you have the right to appeal to Clayton County Superior Court within 30 days.

⚠️ Additional Tips for Clayton County Property Tax Appeals

-

Act Early: Don’t wait until the last day to file.

-

Stay Organized: Label all documentation and keep a copy for your records.

-

Temporary Tax Bill: While your appeal is pending, you may receive a bill based on the original assessed value. Pay it to avoid penalties. Refunds are issued if your value is later reduced.

📚 Resources: Clayton County Property Tax Appeal Tools

File appeals, check values, correct property records