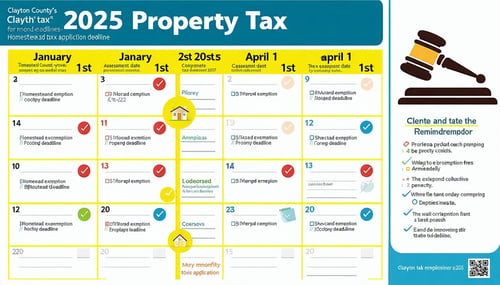

Staying informed about critical deadlines is essential for Clayton County, Georgia property owners—especially when it comes to property assessments, exemptions, appeals, and payments. The 2025 Clayton County property tax calendar outlines the key milestones you need to manage your responsibilities and potentially reduce your tax burden.

Here’s a clear overview of the important dates to keep in mind throughout the 2025 tax year.

🔑 Key Dates and Deadlines for 2025

January 1, 2025

-

Assessment Date: This is the date the fair market value of your property is determined for tax purposes, based on its condition and use on this day.

-

Homestead Exemption Eligibility: You must own and occupy the property as your legal residence on January 1 to qualify for any homestead exemptions for 2025.

-

Tax Return and Exemption Filing Begins: The official filing period for property tax returns and homestead exemptions begins.

January 1 – April 1, 2025

-

Homestead Exemption Application Period: Submit your application by April 1, 2025 to receive the exemption for the current tax year. Late applications will apply to 2026.

-

You may apply online or in person at the Tax Assessor’s Office.

-

-

Property Tax Return Filing Period: If you:

-

Purchased property in 2024,

-

Made significant changes (e.g., additions, demolitions),

-

Changed your name or address,

You may need to file a property tax return (PT-50R) with the Clayton County Board of Tax Assessors.

-

Late April 2025 (Estimated Based on 2024 Timeline)

-

Annual Notice of Assessment Mailed: Around the last week of April, property owners will receive a notice showing:

-

The assessed value of their property for 2025,

-

Any changes in valuation,

-

Instructions on how to file an appeal.

-

⚠️ This date can vary slightly each year—check your mail and the Clayton County Assessor’s website for confirmation.

45 Days from the Date on the Notice of Assessment

-

Deadline to File a Property Tax Appeal: You have 45 days from the mailing date of the Annual Notice of Assessment to file an appeal if you believe the assessed value is too high or inaccurate.

-

Appeals must be submitted to the Clayton County Board of Tax Assessors.

-

You can appeal based on value, uniformity, or taxability.

-

December 20, 2025 (Generally)

-

Property Tax Payment Due: Clayton County typically requires all 2025 property tax bills to be paid by December 20. Confirm the due date on your tax bill.

-

Payments received after the deadline may incur penalties and interest.

-

Some counties offer installment options, but always verify with the Tax Commissioner.

-

📝 Important Reminders

-

Check your mail regularly for any official notices from the Clayton County Tax Assessor or Tax Commissioner.

-

Mark key deadlines on your calendar, especially April 1 (homestead deadline), your assessment notice date, and December 20 (tax payment deadline).

-

Always confirm dates directly with Clayton County offices, as schedules can vary slightly year to year.

📌 Key Takeaways for 2025

-

✅ Homestead Exemption Deadline: April 1, 2025

-

✅ Assessment Notices Mailed: Late April (Estimated)

-

✅ Appeal Deadline: 45 days from the date on your notice

-

✅ Property Tax Payment Due Date: Generally December 20, 2025

By understanding and preparing for these key dates, you can effectively manage your 2025 Clayton County property taxes and take advantage of any savings opportunities available to you.

📚 Resources: Clayton County Property Tax Contacts and Tools

| Resource | Purpose |

|---|---|

| Clayton County Tax Assessor's Office | Property assessments, filing returns, applying for homestead exemptions, and appeal forms |

| Clayton County Tax Commissioner’s Office | Property tax billing, payment info, and online bill pay |

| Georgia Department of Revenue – Property Tax Division | Overview of Georgia tax laws, exemptions, and appeals |

| Appeal Rights Info Sheet (Georgia DOR) | Explanation of your rights during the property tax appeal process |

| Clayton County PT-50R Form (if needed) | Property tax return form for changes in ownership or property improvements |