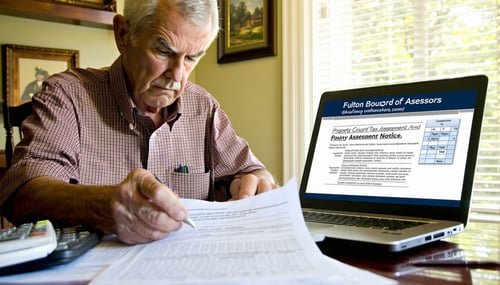

Receiving a sharp, unexpected increase in your Fulton County property tax assessment can be alarming—especially if it doesn't reflect your home's actual value. Understanding the possible reasons behind the increase and knowing how to appeal the assessment are critical steps to ensuring you’re taxed fairly.

Here's a strategic guide to help you navigate this process.

1. 🕵️ Understand Why the Increase Occurred

Start by reviewing your Annual Notice of Assessment, which is typically mailed each spring. Common reasons for an increase include:

-

Market Appreciation: Home sales in your area may have driven up comparable values.

-

Property Improvements: Renovations, additions, or new construction can raise your home's value.

-

Data Corrections: The county may have updated records (e.g., corrected square footage or number of bathrooms).

-

Countywide Revaluation: Fulton County periodically revalues all properties to reflect current market conditions.

2. 📋 Review Your Property Data

Go to the Fulton County Board of Assessors’ website and search for your property record.

-

Verify key property details: square footage, number of bedrooms, lot size, construction type, year built, etc.

-

Look for errors or outdated information—any inaccuracies could lead to overvaluation.

3. 🧾 Gather Evidence to Support Your Appeal

To challenge the new value, you must show that it exceeds your property’s fair market value as of January 1st of the tax year. Use the following evidence:

-

Comparable Sales ("Comps"): Recent sales (within 6–12 months) of similar homes in your area.

-

Certified Appraisal: A professional appraisal provides authoritative valuation evidence (at your cost).

-

Photos and Repair Estimates: Document any issues (e.g., deferred maintenance, structural problems) that lower your home’s value.

-

Market Trends: Reports or data indicating a decline or plateau in local home values.

4. ⏱ File Your Appeal Within 45 Days

You have 45 days from the date listed on your Assessment Notice to file an appeal. Missing this deadline forfeits your right to appeal that year.

You can file your appeal:

-

Online: Via FultonAssessor.org – the fastest and most reliable method.

-

In Person: At a Fulton County Board of Assessors office.

-

By Mail: Use certified mail and send the PT-311A appeal form or a detailed letter of appeal.

5. 🔍 Choose Your Appeal Path

When you file, you must select one of these options:

-

Board of Equalization (BOE) – Free, and the most common for homeowners. A three-person panel hears your case.

-

Non-Binding Arbitration – Requires submitting a certified appraisal. A third party arbitrator reviews both appraisals.

-

Hearing Officer – Available only if your property is non-homestead residential or commercial and valued over $500,000.

6. 🎯 Prepare for Your BOE Hearing

If you select the BOE, be ready to present your case:

-

Bring organized evidence (comps, appraisal, repair estimates, photos).

-

Practice a clear, fact-based explanation of why the assessment is too high.

-

Stay calm and focused—the BOE panel is made up of trained citizens, not county employees.

7. 🔄 Next Steps After the Hearing

-

If the Board of Assessors agrees with your appeal, your assessment may be adjusted without a hearing.

-

If your case proceeds to the BOE, you'll receive their decision by mail.

-

If you disagree with the BOE decision, you can appeal to the Fulton County Superior Court or the Georgia Tax Tribunal within 30 days.

⚠️ Important Considerations

-

Temporary Tax Bill: You must pay at least a partial tax bill while your appeal is pending to avoid penalties or interest. If your appeal succeeds, any overpayment will be refunded.

-

Annual Timeline: Appeals are specific to the current tax year, based on your home’s value as of January 1.

-

Strong Documentation Wins: Focus on fair market value, not how much your tax bill changed.

✅ Summary

A sudden property tax increase doesn’t mean you’re stuck paying more. By understanding the reasons behind the assessment and using the structured Georgia appeal process, you can challenge the value with confidence and evidence.

📚 Resources

Fulton County & Georgia Property Tax Resources:

-

Fulton County Board of Assessors

https://fultonassessor.org -

Appeal Form (PT-311A)

https://dor.georgia.gov/documents/property-tax-appeal-form-pt311a -

Fulton County Tax Commissioner

https://taxcommissioner.fultoncountyga.gov -

Georgia Department of Revenue – Property Tax

https://dor.georgia.gov/property-tax -

Georgia Tax Tribunal

https://gataxtribunal.georgia.gov -

Fulton County Superior Court

https://www.fultonclerk.org