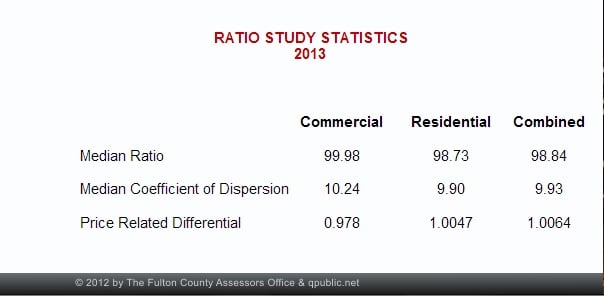

The Fulton County tax Assessors have posted some sale ratios statistics on their website showing how well they have done with their 2013 reappraisal. At first glance, these statistics look stellar given that Fulton is such a large, diverse county. Take a look:

The median ratio is an indication of the level of appraisal. For example, if they took all of the commercial sales in Fulton County and divided their 2013 assessments by the sales prices and arrayed them from low to high, or high to low, the median ratio is nearly 100% of market value. One way to get a high median ratio, such as those shown for both commercial and residential properties is to assess those properties that have sold at their sale prices. This is called chasing the sale and the Georgia Department of Revenue hates this practice. Typically, when a County chases sales they only increase the value of the property that has sold and they do not increase the values of comparable properties in the sold property's immediate market area.

The coefficient of dispersion is a measure of uniformity in the sale ratio study. The COD is the average absolute deviation about the median expressed as a percentage of the median. For commercial properties in large urban areas the coefficient of dispersion should be 15% or less. For residential properties the COD should be 15% or less generally, and 10% or less in areas of newer or fairly similar residences. This is based on sale ratio standards published by the International Association of Assessing Officers.

Given that the coefficients of dispersion for both commercial and residential properties are approximately 10% we can say that Fulton County tax assessors didn't chase all the sales because there is some deviation in sale ratios about the median sale ratio. The fact that there is some deviation and that the median assessor sale ratio is so high means that half of the sold properties are over appraised and half of the sold properties are under appraised. There may be a large group of properties that are assessed very, very close to their sale price.

When assessors have a high median sale ratio and they have adjusted ALL property values in the respective neighborhoods accordingly, then approximately half of the neighborhood will be overappraised and half of the neighborhood will be underappraised. Mass appraisal is an inexact science and when you have a high ratio and a relatively low COD as the Fulton County Tax Assessors are showing, you can say they are being aggressive in their level of assessment, but their assessments are uniformly aggressive.

It will be interesting to see the average percentage increase in assessment for those properties that have sold in a neighborhood vs. the percentage assessment increase for the other properties in the same neighborhood. If the average increase in assessment for the sales is say, 20%, but the rest of the neighborhood received a 10% increase, then these sale ratio statistics somewhat artificial, and don't show a true picture of what is happening with the Fulton County tax digest. More on this at a later time.