Things have not been going well for the tax offices of Atlanta GA; there have been continued complaints from home owners in Fulton that they are being systematically overtaxed through overstated values and business owners have similar concerns with many increasingly saying they will be unable to pay what they see as extortionate tax bills. To add to this, another in an increasingly long line of individuals, connected to the valuation of properties, has come into the lime light for all the wrong reasons. Donald Johnson is an Atlanta GA tax assessor and one of five who administer the setting of fair market values on homes, businesses and land lots throughout the county. The market values determine how much the taxpayers are billed. Johnson has recently had his license to practice as a professional appraiser revoked by the Georgia Real Estate Appraisers Board after allegations of incompetence, negligence, and falsifying documents related to several appraisals. Between 2005 and 2007 Johnson was found to have over valued three quadruplexes and a town house, and was accused of ignoring the values of houses on the same street and, instead, used values of homes over a mile away to set the value of the properties.

The Atlanta GA tax assessor narrowly avoided a six month suspension from the board of assessors, after an Administrative Law Judge found that there was insufficient evidence of fraud. Johnson cannot be made to step down from his position on the board of assessors, and has, so far, refused polite requests to do so. It is his belief that his private work as an appraiser has no bearing on his position as an Atlanta GA tax assessor.

The people of Fulton may, however, disagree with him on this point; in August of this year between 6,500 and 7,000 property owners received tax bills that were too high because the tax assessor’s office did not enter tax appeals into the system before the tax commissioner’s office generated bills for that coming year. The cost of sending out new bills totaled $2000 which is exceptional small when compared to the problems of the previous year.

In 2011 around 136,000 property owners in the Atlanta area received tax estimates that were too high. This was blamed on a computer glitch and missed by staff; 230,000 new assessment notices were mailed out with a cost of $140,000. You would think this would be enough, but the incompetence and problems go much further back.

Johnson is not the only Atlanta GA tax assessor to be thrown under the spotlight; last year a North Fulton appointee was asked to resign, after being judged to have been negligent by the state board. Ricky Kenny was said to have deliberately overvalued a duplex in 2005. He also refused to resign his position, and managed to avoid losing his appraisers license by agreeing to pay $5,000 in administrative and legal costs, and taking six hours of classes on mortgage fraud.

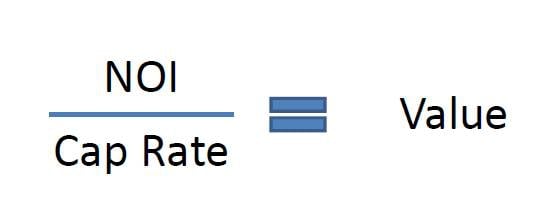

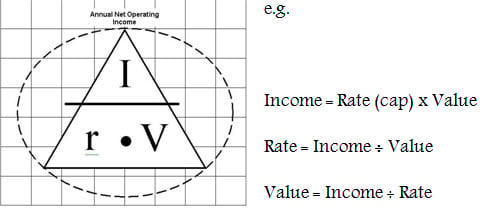

While the law seems to have its hands tied in terms of being able to force an Atlanta GA Tax Assessor to stand down unless criminal charges are brought, there are still many people dealing with the effects of overvaluations and high tax bills. Several of those who had their property overvalued by Johnson have found themselves facing foreclosure and losing homes or businesses. There is an appeals process for home, business and land owners who believe they have been subject to an overvaluation, but it is a long process that requires them to understand how the valuation is carried out, and to be able to prove that the Atlanta GA tax assessor's value is wrong, or inequitable. This requires time and research, but can be fruitful in the end.