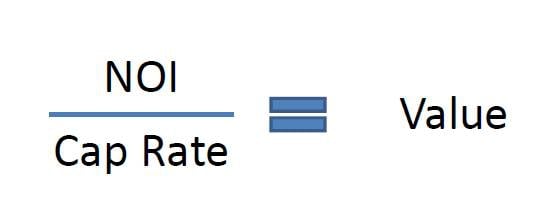

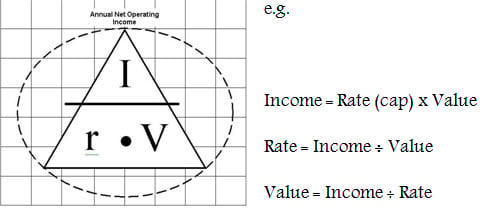

Direct capitalization is used to convert a single year's income into a value estimate. The income is converted by a capitalization rate. Capitalization rates can be determined in a variety of ways, but the best way is to derive them from market transactions of similar properties. The overall capitalization rate is determined by dividing a single year's net operating income (NOI) by the sale price of the comparable property. From an adequate sample of market transactions an appropriate capitalization rate can be reconciled and used to estimate the value of similar properties.

If you have a 10 year old community retail center in "Eastside Neighorhood" then ideally you will use sales of retail centers in this neighborhood, that are similar in age, quality, size, etc. You must be certain that the sale comparables used have net operating income calculated in the same way as the subject NOI. Any financing that affected the sale prices of the comparables requires adjustment, as do nonmarket rents. The objective is to compare apples to apples, because a small change in capitalization rate can result in a big difference in the value estimate.