Taxes are an inevitable part of life, an unpleasant one maybe but essential to the running of the country. In most cases, you receive the bill, grumble about it and then see that it gets paid; just occasionally though you receive a tax bill that doesn’t seem right. What can you do when the tax bill you receive for your commercial property doesn’t seem fair? By following a few simple steps and putting all your evidence together, you can appeal against the amount you are being charged and try to get the bill lowered.

Facts That Determine Assessment

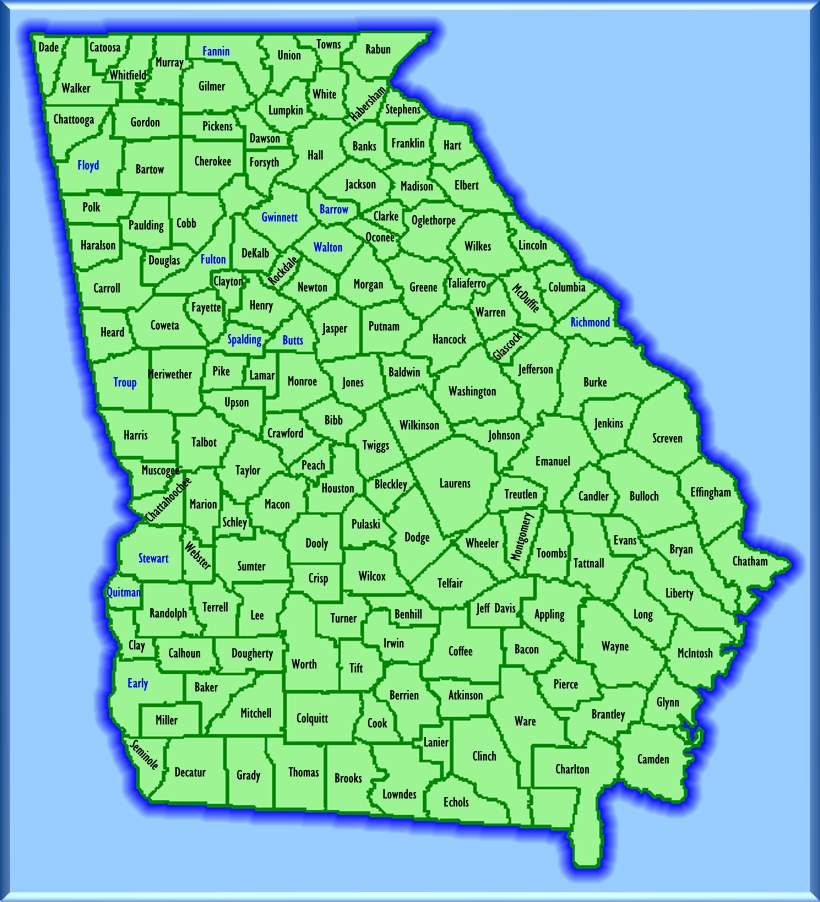

Property taxes in Fulton start with the Fulton tax assessors whose responsibility it is to work out the value of a property before applying 40% to that amount to reach the assessed value of the property on which the tax is based. To get some understanding of whether your tax bill is fair you will need to compare it with those sent to owners of similar properties and, if possible, get help from someone, such as a realtor, who has a good understanding of property values in your area.

However, commercial property taxes are not based purely on the value of the building and to create a case against the assessment of the Fulton tax assessors you will also need to know your expense ratio, net operating income, and capitalization rate. The best way to get your capitalization rate is to derive it from the sales of similar properties.

Once you have these figures you are ready to start to build an appeal case; the next step is to decide on what grounds you are going to base the appeal. You could choose to argue that the market rental rate is lower than the rate that has been used by the Fulton tax assessors. If you can find grounds to do so you can argue that your property is unique and will, therefore, never have the low expense ratio that was used in the assessment. The third option is to argue that the capitalization rate used is the assessment was too low.

The Appeal Process

The Fulton tax assessor’s offices set out a 45 day period from receiving your tax notice, to lodge your appeal. If you are sending documentation to their office, it is always a good idea to send it as certified mail so that you receive confirmation that your documents have reached their destination. Appealing in person can involve an informal discussion with the County appraiser and allows you the opportunity to explain why you disagree with the assessor's decision, and to ask questions. Prior to any meeting, send only the necessary documentation, and take the rest with you as further evidence of your case.

If you lose your appeal at this stage, it is not necessarily the end of the process; you can choose to have your case heard by the Board of Equalization which is free or you could choose to go to arbitration. When attending your appeal hearing remember to be on time, to explain your case clearly and to listen carefully to what is being said. The hearings are quite short, and you may have a lot of details to go through, but stick to the point and keep it short and business like. Whatever else you do, remember to stay calm and professional.

Arbitration does have costs attached but may be the best option if you have had mixed previous experiences with using the Board of Equalization. If you are still not in agreement with their decision then your final option is the Superior Court appeal, whose judgment on the matter is final.